Ri car tax Idea

Home » Trending » Ri car tax IdeaYour Ri car tax images are available in this site. Ri car tax are a topic that is being searched for and liked by netizens today. You can Find and Download the Ri car tax files here. Download all free photos and vectors.

If you’re searching for ri car tax pictures information connected with to the ri car tax topic, you have pay a visit to the right site. Our site frequently gives you suggestions for downloading the maximum quality video and image content, please kindly surf and locate more enlightening video content and images that match your interests.

Ri Car Tax. 2020 motor vehicle tax bills. Tax collection is located on the first floor of city hall in room 104. We aim to exceed the expectations of our resident customers. The 2020 bills were delayed due to the general assembly’s budget process and the uncertanity on whether the state would continue the planned gradual phase out of the tax.

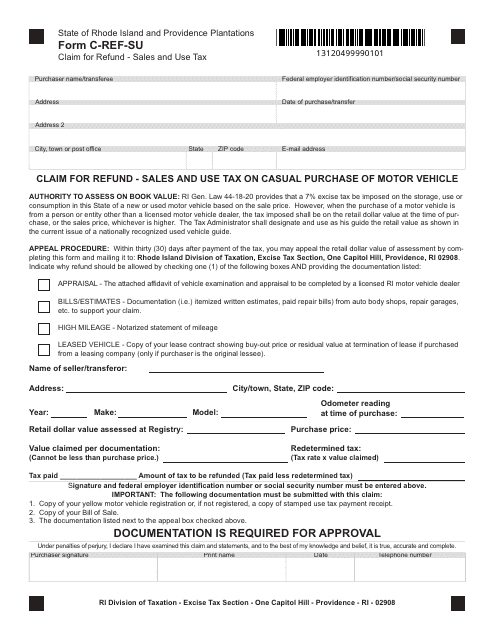

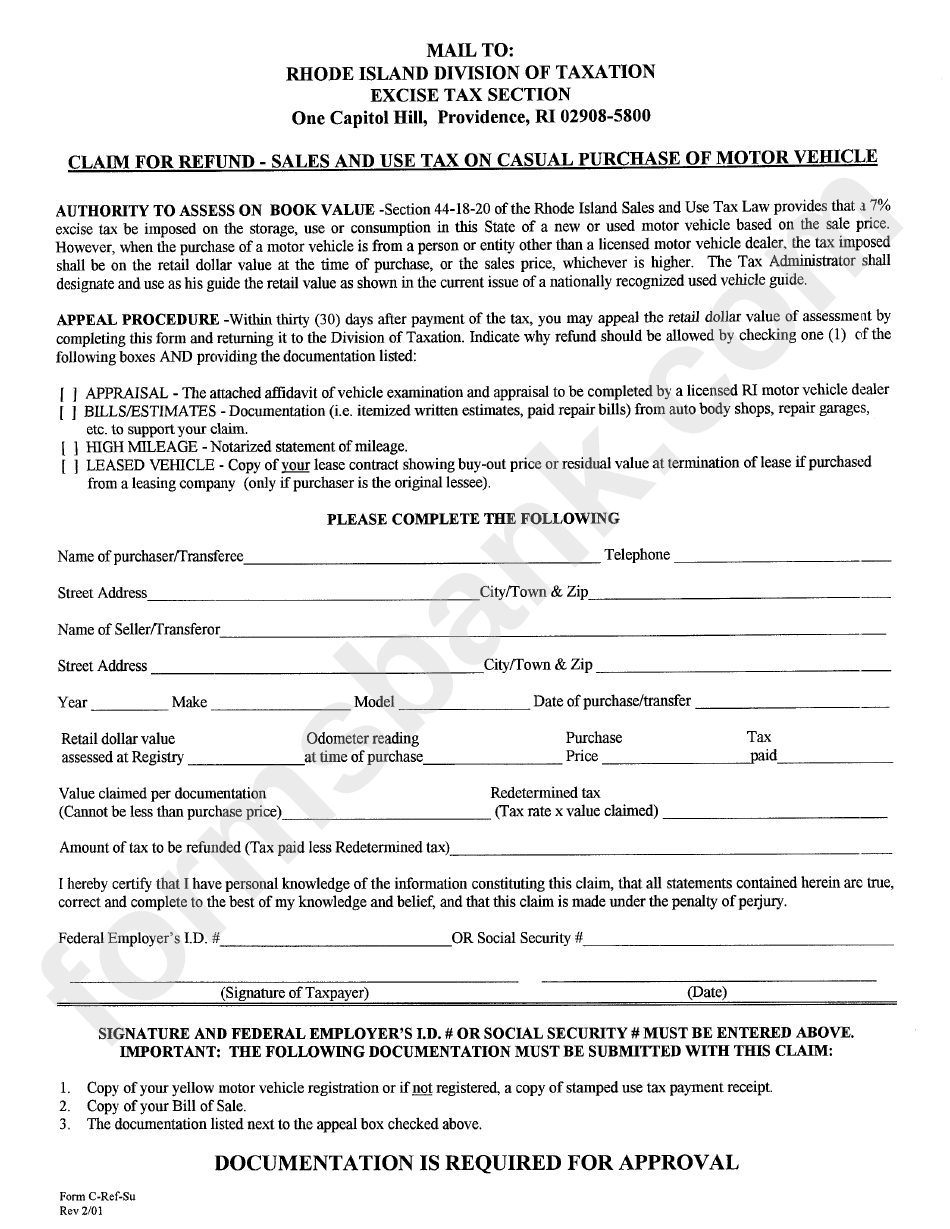

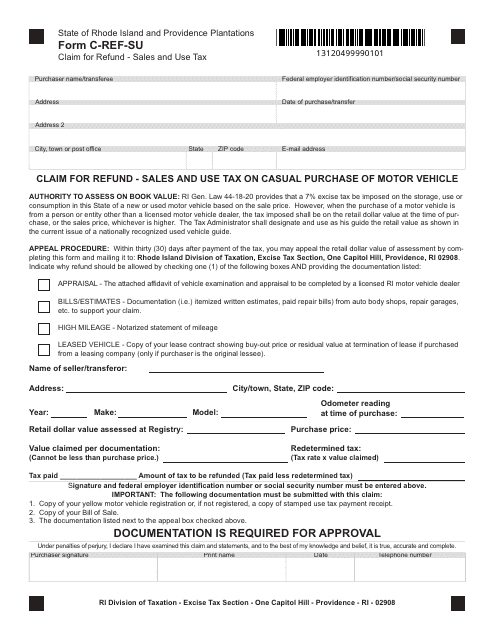

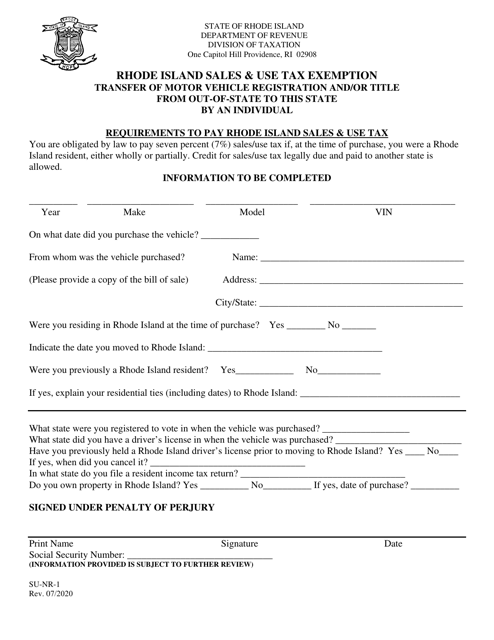

Form CREFSU Download Fillable PDF or Fill Online Claim From templateroller.com

Form CREFSU Download Fillable PDF or Fill Online Claim From templateroller.com

Motor vehicle tax appeal forms are being accepted through wednesday, october 6, 2021. The tax collector�s office collects real estate tax, personal property tax, motor vehicle tax, water and sewer payments. This bill reflects registrations for calendar year 2019. Rates & tax calculation 2021 tax rates. Vehicles registered in providence, ri are taxed for the previous calendar year. Tax rates | ri division of municipal finance.

Please enter either your property tax account number, or your motor vehicle tax number below.

Every person, firm or organization engaged in the business of making retail sales in this state is required to obtain a permit. The tax collector�s office collects real estate tax, personal property tax, motor vehicle tax, water and sewer payments. Contact us customer service agreement question/feedback form This bill reflects registrations for calendar year 2019. We allow for estimated payments, extension payments, payments with a tax filing, license renewal payments, bill payments and payments for various fees. A resident of pawtucket, with a high $53.30 tax rate and a minimum $500 exemption who owns a $40,000 vehicle, would pay a $2,105 car tax.

Source: rimonthly.com

Source: rimonthly.com

It would also cap the value of vehicles for which. You can find these fees further down on the page. Tax collection is located on the first floor of city hall in room 104. Mayor frank picozzi announced the city’s car tax bills are being mailed out this month. There are three components that determine how much each individual car is taxed:

Source: formsbank.com

Source: formsbank.com

A resident of pawtucket, with a high $53.30 tax rate and a minimum $500 exemption who owns a $40,000 vehicle, would pay a $2,105 car tax. Sales tax is 7% of nada clean retail book value and/or black book cpi or purchase price, whichever is greater. Beginning with the 2017 tax, vehicles over 15 years old (2002 model year and older) will not be taxed. Tax rates | ri division of municipal finance. A resident of pawtucket, with a high $53.30 tax rate and a minimum $500 exemption who owns a $40,000 vehicle, would pay a $2,105 car tax.

Source: golocalprov.com

Source: golocalprov.com

The car tax is also considered a regressive tax, because it represents a larger percentage of income for lower and middle. We aim to exceed the expectations of our resident customers. Mail payment and quarterly coupon to. Every person, firm or organization engaged in the business of making retail sales in this state is required to obtain a permit. We allow for estimated payments, extension payments, payments with a tax filing, license renewal payments, bill payments and payments for various fees.

Source: infotracer.com

Source: infotracer.com

It�s almost always better for a married couple to file a joint tax return. A separate check is requested for each account being paid. For vehicles that are being rented or leased, see see taxation of leases and rentals. There are three components that determine how much each individual car is taxed: 2020 motor vehicle tax bills on the way to warwick residents.

Source: patch.com

Source: patch.com

Property tax / motor vehicle tax id number: The motor vehicle tax (commonly known as the “ar tax”) is a property tax collected by each rhode island municipality based on the value of each motor vehicle owned. Rhode island collects a 7% state sales tax rate on the purchase of all vehicles. 2020 motor vehicle tax bills on the way to warwick residents. Sales tax is 7% of nada clean retail book value and/or black book cpi or purchase price, whichever is greater.

Source: economicprogressri.org

Source: economicprogressri.org

Rhode island division of taxation. Our mission in the tax collection division is to provide residents with fast, accurate payment processing, and with a courteous resolution of any payment issues that they may have. Valuation, tax rate and exemption. The 2020 bills were delayed due to the general assembly’s budget process and the uncertanity on whether the state would continue the planned gradual phase out of the tax. Mayor frank picozzi announced the city’s car tax bills are being mailed out this month.

Source: news.cchgroup.com

Source: news.cchgroup.com

The tax collector�s office collects real estate tax, personal property tax, motor vehicle tax, water and sewer payments. For additional information please contact: For vehicles that are being rented or leased, see see taxation of leases and rentals. This applies to passenger vehicles and motor homes only. Due dates are 10/15/20, 1/15/21, and 4/15/21.

Source: patch.com

Source: patch.com

Every person, firm or organization engaged in the business of making retail sales in this state is required to obtain a permit. There are three components that determine how much each individual car is taxed: Please be advised payments made by. Payments accepted include real estate, tangible property and motor vehicle excise taxes. It�s almost always better for a married couple to file a joint tax return.

Source: patch.com

Source: patch.com

Visit our tax portal information page for more information including a detailed list of what services are available on our portal and how to create an account. If you cannot find the exact department/person you are looking for, the. The 2020 bills were delayed due to the general assembly’s budget process and the uncertanity on whether the state would continue the planned gradual phase out of the tax. Individuals, businesses, and cpas may use the portal to make payments from a checking or savings account and businesses may file their returns online. Visit our tax portal information page for more information including a detailed list of what services are available on our portal and how to create an account.

Source: templateroller.com

Source: templateroller.com

The car tax is not a real time tax! Due dates are 10/15/20, 1/15/21, and 4/15/21. You are taxed on how many days out of 365 days of the year your vehicle is registered. Mail payment and quarterly coupon to. Motor vehicle tax appeal forms are being accepted through wednesday, october 6, 2021.

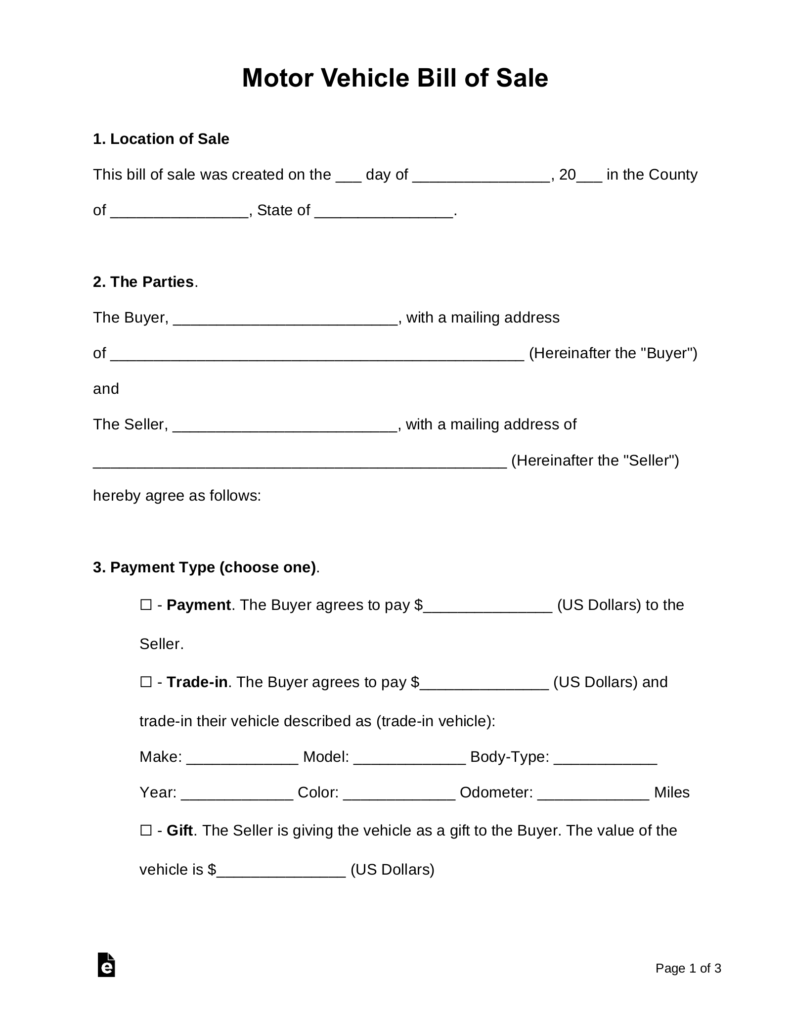

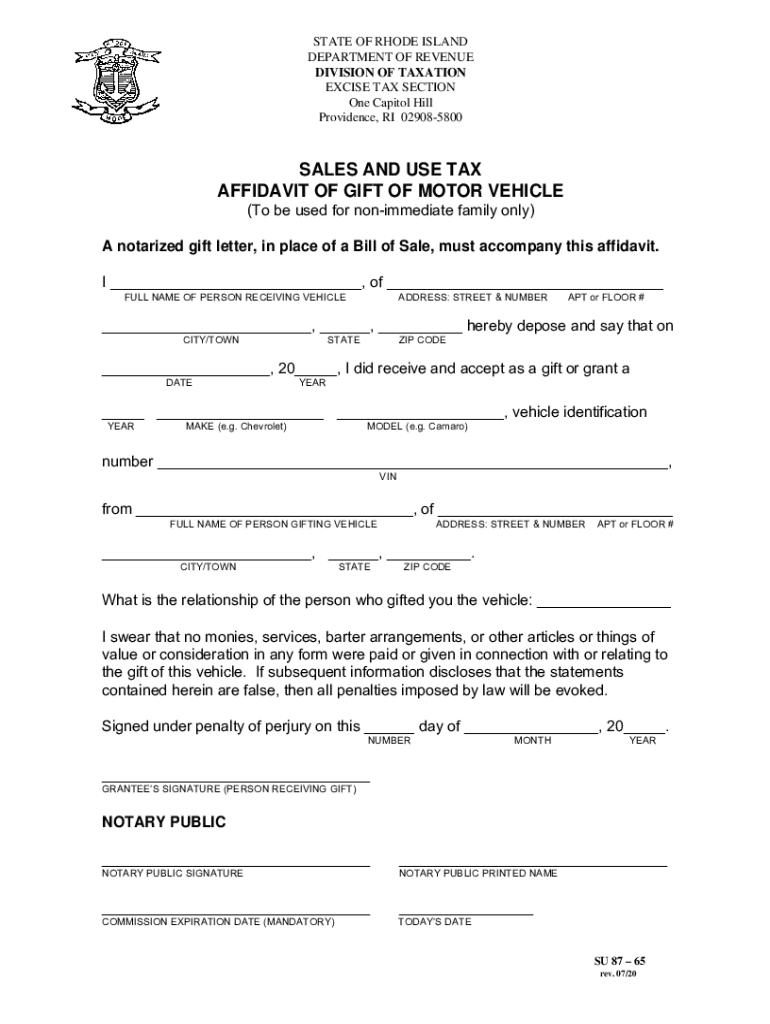

Source: dmvbillofsaleform.net

Source: dmvbillofsaleform.net

Motor vehicle tax appeal forms are being accepted through wednesday, october 6, 2021. Select the type of payment you would like to make from the select tax payment type menu above.you can also view your current and previous year tax statements by selecting the tax statements menu above.please be advised payments made by credit/debit cards will be charged a convenience fee of 2.85% of the. A resident of pawtucket, with a high $53.30 tax rate and a minimum $500 exemption who owns a $40,000 vehicle, would pay a $2,105 car tax. Complementing the sales tax, a use tax is imposed at 7% on the storage, use or consumption in this state of tangible personal property. This applies to passenger vehicles and motor homes only.

Source: templateroller.com

Source: templateroller.com

Rates & tax calculation 2021 tax rates. This bill reflects registrations for calendar year 2019. Please enter either your property tax account number, or your motor vehicle tax number below. Contact us customer service agreement question/feedback form Property tax / motor vehicle tax id number:

Source: signnow.com

Source: signnow.com

The tax collector�s office collects real estate tax, personal property tax, motor vehicle tax, water and sewer payments. The tax collector�s office collects real estate tax, personal property tax, motor vehicle tax, water and sewer payments. Visit our tax portal information page for more information including a detailed list of what services are available on our portal and how to create an account. Welcome to the town of westerly�s tax collection webpage. It would also cap the value of vehicles for which.

Source: prorfety.blogspot.com

Source: prorfety.blogspot.com

This bill reflects registrations for calendar year 2019. There are three components that determine how much each individual car is taxed: For example, the 2017 tax bill is for vehicles registered during the 2016 calendar year. For vehicles that are being rented or leased, see see taxation of leases and rentals. 2020 motor vehicle tax bills.

Source: youtube.com

Source: youtube.com

It would also cap the value of vehicles for which. Sales tax is 7% of nada clean retail book value and/or black book cpi or purchase price, whichever is greater. Select the type of payment you would like to make from the select tax payment type menu above.you can also view your current and previous year tax statements by selecting the tax statements menu above.please be advised payments made by credit/debit cards will be charged a convenience fee of 2.85% of the. To make a payment click here. A resident of block island, with a $9.75 rate and $1,000 exemption, would only pay $380 for the same car.

Source: billofsale.net

Source: billofsale.net

Every person, firm or organization engaged in the business of making retail sales in this state is required to obtain a permit. To make a payment click here. Residents can pay their taxes using the following options: Due dates are 10/15/20, 1/15/21, and 4/15/21. Rates & tax calculation 2021 tax rates.

Source: roblevine.com

Source: roblevine.com

Contact us customer service agreement question/feedback form Individuals, businesses, and cpas may use the portal to make payments from a checking or savings account and businesses may file their returns online. For vehicles that are being rented or leased, see see taxation of leases and rentals. A resident of pawtucket, with a high $53.30 tax rate and a minimum $500 exemption who owns a $40,000 vehicle, would pay a $2,105 car tax. Summary of rhode island’s car tax.

Source: golocalprov.com

There are three components that determine how much each individual car is taxed: 2020 motor vehicle tax bills. Welcome to the town of westerly�s tax collection webpage. In addition to taxes, car purchases in rhode island may be subject to other fees like registration, title, and plate fees. The current tax rates and exemptions for real estate, motor vehicle and tangible property.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title ri car tax by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.