Oregon sales tax on cars information

Home » Trend » Oregon sales tax on cars informationYour Oregon sales tax on cars images are ready. Oregon sales tax on cars are a topic that is being searched for and liked by netizens now. You can Get the Oregon sales tax on cars files here. Get all free photos and vectors.

If you’re searching for oregon sales tax on cars pictures information linked to the oregon sales tax on cars interest, you have come to the right site. Our website frequently provides you with suggestions for viewing the maximum quality video and picture content, please kindly surf and locate more enlightening video content and images that fit your interests.

Oregon Sales Tax On Cars. Ad stay connected to the most critical events of the day with bloomberg. The vehicle privilege tax is a tax on selling new vehicles in oregon. Unfortunately, unless you register the car in the sales. About sales tax in oregon oregon doesn�t have a general sales or use/transaction tax.

Oregon’s Initiative Petition 28 Tax Foundation From taxfoundation.org

Oregon’s Initiative Petition 28 Tax Foundation From taxfoundation.org

Anyway, back on topic, though the tax on cars is calculated at local sales tax rates, it is not actually a sales tax per se, but a use or excise tax. However, oregon does have a vehicle use tax that applies to new vehicles purchased outside of the state. Under the tax, dealers can pass along the privilege tax through the final sales price of the vehicle. Ad stay connected to the most critical events of the day with bloomberg. Set by the oregon department of motor vehicles (dmv), these depend on the type of vehicle you are purchasing. The vehicle privilege tax is a tax on selling new vehicles in oregon.

The state sales tax for vehicle purchases in oregon is 0%.

Though delaware doesn�t impose a state sales tax, it does require certain businesses to pay a gross receipts tax. Do i have to pay sales tax on a used car in oregon? Is shopping in portland free tax? From ca to fl was about $1900 if memory serves. States with no sales tax on cars these five states do not charge sales tax on cars that are registered there: Only five states do not have statewide sales taxes:

Source: nwpb.org

Source: nwpb.org

The oregon (or) sales tax rate. Because oregon has no sales tax, you�re paying for either shipping or tax. They do not, however, the issue is a bit more complicated than that. From ca to fl was about $1900 if memory serves. Oregon doesnt have a general sales or usetransaction tax.

Source: carsalerental.com

Source: carsalerental.com

About sales tax in oregon oregon doesn�t have a general sales or use/transaction tax. Have 7,500 or fewer miles weigh 26,000 pounds or less have not been titled in oregon They do not, however, the issue is a bit more complicated than that. Ad stay connected to the most critical events of the day with bloomberg. Montana, alaska, delaware, oregon, and new hampshire.

Source: baumannfordoregon.com

Source: baumannfordoregon.com

Montana, alaska, delaware, oregon, and new hampshire. 3 takes aim at a 0.5 percent “privilege” tax on dealers for every new car sold in oregon. New hampshire, delaware, montana, oregon, and alaska. About sales tax in oregon oregon doesn�t have a general sales or use/transaction tax. Since oregon does not have sales tax, i was originally considering waiting until i got up there to buy a car.

Source: kuow.org

Source: kuow.org

Oregon and portland, in contrast, have no sales tax. Unfortunately, unless you register the car in the sales. As long as the consumer pays a local sales tax, he or she will not receive a refund. But, rest assured if you are an oregonian you will not have to pay washington sales tax when you purchase an automobile in washington. The vehicle privilege tax is a tax on selling new vehicles in oregon.

Source: mercedesbenzwilsonville.com

Source: mercedesbenzwilsonville.com

The state sales tax for vehicle purchases in oregon is 0%. Because oregon has no sales tax, you�re paying for either shipping or tax. New hampshire, delaware, montana, oregon, and alaska. The vehicle privilege tax is a tax on selling new vehicles in oregon. The most straightforward way is to buy a car in a state with no sales taxes and register the vehicle there.

Source: wweek.com

Source: wweek.com

Washington, dc, the nation�s capital, does not charge sales tax on cars, either. Some other states offer the opportunity to buy a vehicle without paying sales tax. The most straightforward way is to buy a car in a state with no sales taxes and register the vehicle there. No washington sales tax for oregon buyers on vehicle purchase car buyers beware cheapest and most expensive states for sales taxes in the united states wikipedia Oregon doesnt have a general sales or usetransaction tax.

Source: dickhannah.com

Source: dickhannah.com

Since oregon does not have sales tax, i was originally considering waiting until i got up there to buy a car. They do not, however, the issue is a bit more complicated than that. What is the sales tax on cars purchased in oregon? The vehicle privilege tax is a tax on selling new vehicles in oregon. Ad stay connected to the most critical events of the day with bloomberg.

Source: dickhannah.com

Source: dickhannah.com

There is no sales tax on any vehicle purchased in oregon. 1, 2018, there’s a tax on the privilege of selling new vehicles in oregon, a use tax for vehicles that were purchased in other states, and a tax on the sale of bicycles. The oregon (or) sales tax rate. The vehicle privilege tax is a tax on selling new vehicles in oregon. The tax operates like a b&o tax, imposing a 0.5% tax on the retail price of new motor vehicles, effective january 1, 2018.

Source: carsalerental.com

Source: carsalerental.com

3 takes aim at a 0.5 percent “privilege” tax on dealers for every new car sold in oregon. 3 takes aim at a 0.5 percent “privilege” tax on dealers for every new car sold in oregon. Do i have to pay sales tax in washington if im from oregon? Only five states do not have statewide sales taxes: Do i have to pay sales tax on a used car in oregon?

Source: kuow.org

Source: kuow.org

Is shopping in portland free tax? Oregon dealers have the option of collecting the taxable amount from the buyer or absorbing it as overhead, but remain the party ultimately liable for remitting the tax. Only five states do not have statewide sales taxes: Have 7,500 or fewer miles weigh 26,000 pounds or less have not been titled in oregon Oregon is one of the five states that do not have any sales tax on car purchases.

Source: oregon.buysellsearch.com

Source: oregon.buysellsearch.com

The portland, oregon, general sales tax rate is 0%. About sales tax in oregon oregon doesn�t have a general sales or use/transaction tax. As long as the consumer pays a local sales tax, he or she will not receive a refund. Do i have to pay sales tax in washington if im from oregon? No washington sales tax for oregon buyers on vehicle purchase car buyers beware cheapest and most expensive states for sales taxes in the united states wikipedia

Source: nwpb.org

Source: nwpb.org

1 2018 theres a tax on the privilege of selling new vehicles in oregon a use tax for vehicles that were purchased in other states and a tax on the sale of bicycles. Washington, dc, the nation�s capital, does not charge sales tax on cars, either. Do i have to pay sales tax on a used car in oregon? While the wa sales tax exemption for oregon residents did change on july 1, 2019, this does not include the sale of vehicles. There is no sales tax on any vehicle purchased in oregon.

Source: oregonlive.com

Source: oregonlive.com

As of january 1, 2020, certain oregon businesses will need to pay a new corporate activity tax (cat). No washington sales tax for oregon buyers on vehicle purchase car buyers beware cheapest and most expensive states for sales taxes in the united states wikipedia 1, 2018, there’s a tax on the privilege of selling new vehicles in oregon, a use tax for vehicles that were purchased in other states, and a tax on the sale of bicycles. Is shopping in portland free tax? Montana, alaska, delaware, oregon, and new hampshire.

Source: taxfoundation.org

Source: taxfoundation.org

Oregon (or) sales tax rates by city. Unfortunately, unless you register the car in the sales. 1 2018 theres a tax on the privilege of selling new vehicles in oregon a use tax for vehicles that were purchased in other states and a tax on the sale of bicycles. About sales tax in oregon oregon doesn�t have a general sales or use/transaction tax. The tax operates like a b&o tax, imposing a 0.5% tax on the retail price of new motor vehicles, effective january 1, 2018.

Source: planetizen.com

Source: planetizen.com

Have 7,500 or fewer miles weigh 26,000 pounds or less have not been titled in oregon Oregon residents can continue to buy vehicles here at overturf volkswagen and they will not pay washington state sales tax. Sales taxes on cars are often hefty, so you may try to avoid paying them. 1, 2018, there’s a tax on the privilege of selling new vehicles in oregon, a use tax for vehicles that were purchased in other states, and a tax on the sale of bicycles. Have 7,500 or fewer miles weigh 26,000 pounds or less have not been titled in oregon

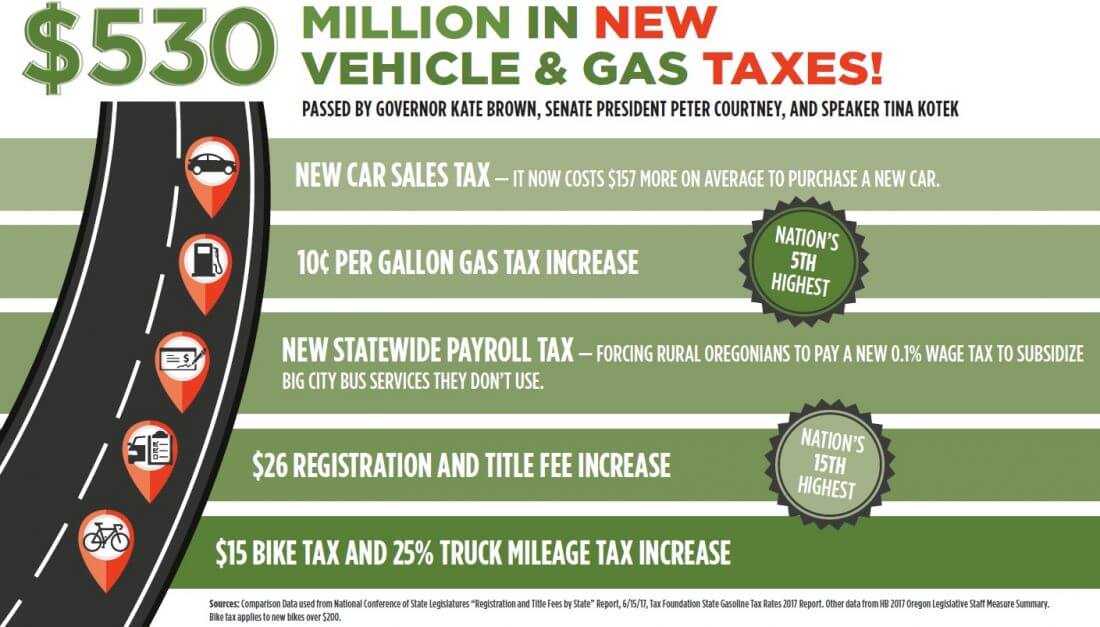

Source: oregoncatalyst.com

Source: oregoncatalyst.com

While the wa sales tax exemption for oregon residents did change on july 1, 2019, this does not include the sale of vehicles. As of january 1, 2020, certain oregon businesses will need to pay a new corporate activity tax (cat). Oregon doesn�t have a general sales or use/transaction tax. Under the tax, dealers can pass along the privilege tax through the final sales price of the vehicle. What is the sales tax on cars purchased in oregon?

Source: cpapracticeadvisor.com

Source: cpapracticeadvisor.com

Ad stay connected to the most critical events of the day with bloomberg. Only five states do not have statewide sales taxes: Anyway, back on topic, though the tax on cars is calculated at local sales tax rates, it is not actually a sales tax per se, but a use or excise tax. Washington, dc, the nation�s capital, does not charge sales tax on cars, either. The portland, oregon, general sales tax rate is 0%.

Source: speckhyundai.com

Source: speckhyundai.com

However, oregon does have a vehicle use tax that applies to new vehicles purchased outside of the state. While the wa sales tax exemption for oregon residents did change on july 1, 2019, this does not include the sale of vehicles. Regarding shipping, i�d recommend a door to door covered/enclosed carrier. The tax must be paid before the vehicle can be titled and registered in oregon. Because oregon has no sales tax, you�re paying for either shipping or tax.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title oregon sales tax on cars by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.