Navy federal car refinance Idea

Home » Trending » Navy federal car refinance IdeaYour Navy federal car refinance images are ready. Navy federal car refinance are a topic that is being searched for and liked by netizens today. You can Find and Download the Navy federal car refinance files here. Find and Download all royalty-free photos.

If you’re searching for navy federal car refinance pictures information related to the navy federal car refinance topic, you have come to the ideal blog. Our website frequently gives you hints for refferencing the maximum quality video and picture content, please kindly surf and find more informative video articles and images that fit your interests.

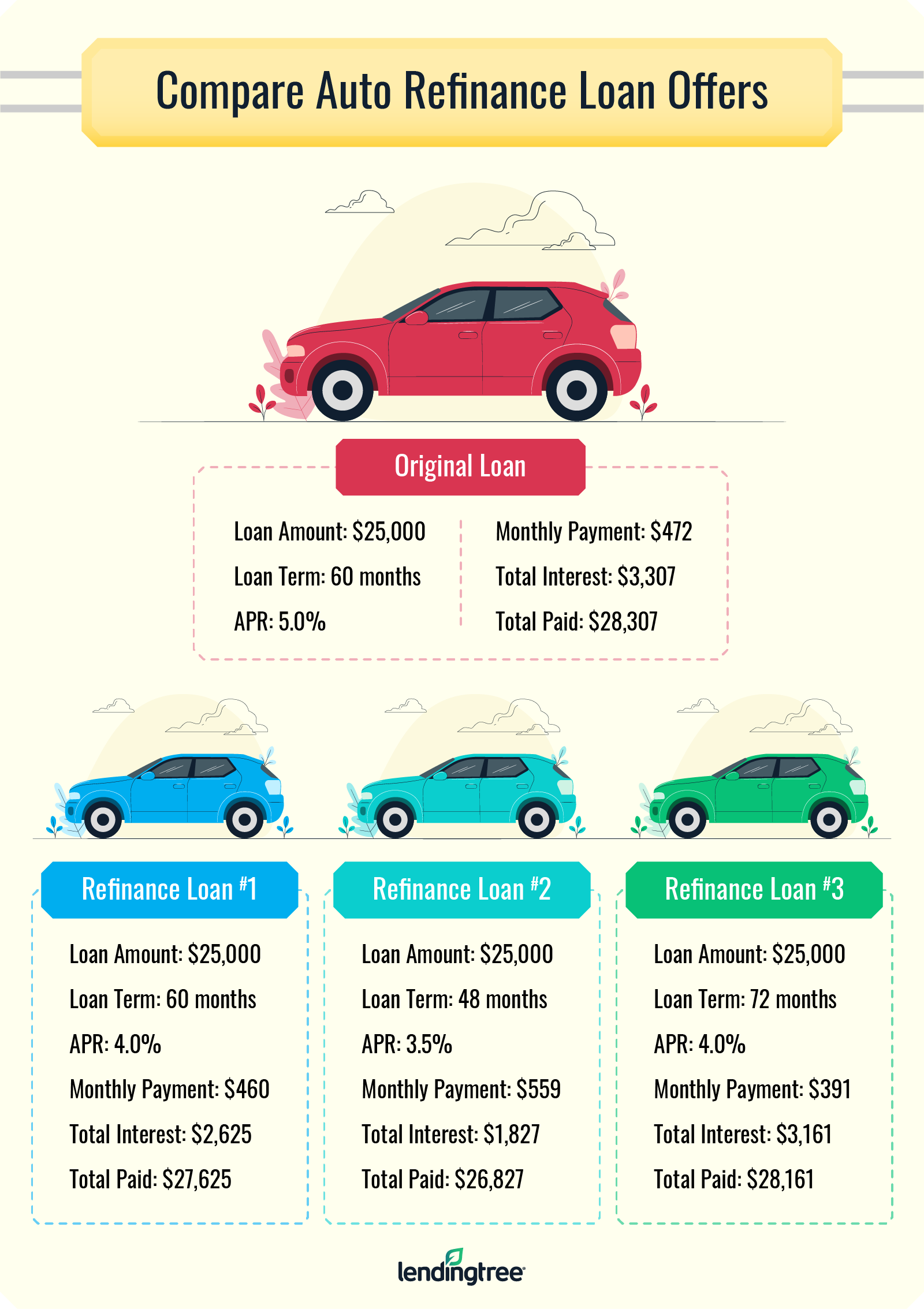

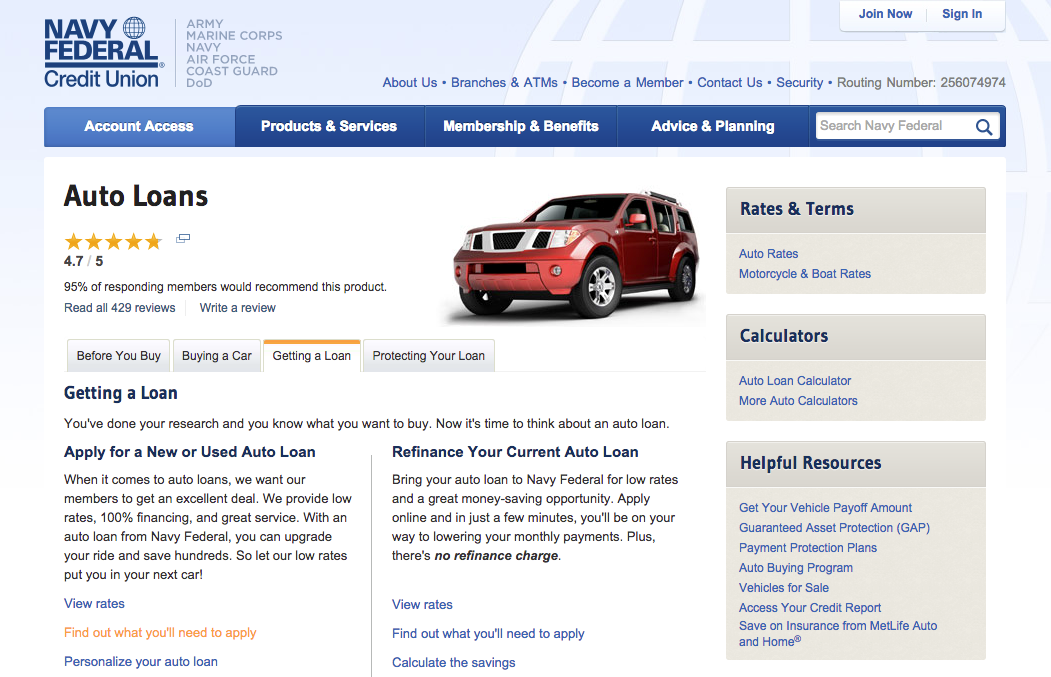

Navy Federal Car Refinance. Navy federal credit union, the nation’s largest credit union, partnered with blend earlier this year to help navigate the effects of 2020’s refinance boom.many financial institutions faced similarly challenging positions this year, wading through a record number of refinance applications in the midst of a shift to a largely remote working environment. Refinancing your car loan from another lender with navy federal could save you money and allow you to set the term that works best for you. Your apr can vary depending on several factors such as your credit score. Serving the navy, army, marine corps, air force, veterans, and dod.

Navy Federal Refinance Car Loan Rates Mortgage Refinance From yeah-thats-my-life.blogspot.com

Navy Federal Refinance Car Loan Rates Mortgage Refinance From yeah-thats-my-life.blogspot.com

Unfortunately, your request for credit has not met navy federal lending criteria for approval. Navy federal credit union we serve where you serve. Navy federal credit union offers annual percentage rates (apr) which are as low as 1.79%. If you didn�t finance your auto loan at navy federal, now�s your chance! Negative reviews range from complaints about being denied for personal loans to closing credit cards without notice to long approval processes. You must be a member of navy federal credit union to apply for one of its auto loans — although those eligible for membership may also be able to apply.

Their rates i have see go as low as a hair less than 1% even for new cars.

Auto refinance loan must be at least $5,000. She said based on my credit if approved my interest rate would be 12% which is bananas considering my. Auto refinance loan must be at least $5,000. By phone, online and in person. We will cover 5 great optio. New auto loan of $20,000 for 36 months at 1.79% apr will have a monthly payment of $572.

Source: youtube.com

Source: youtube.com

In the last three years, the credit union closed 921 complaints. My credit score is 582. Navy federal credit union offers car loan refinance options that can lower your interest rate and help save you money. 2020 and older model years or any model year with over 30,000 miles. Your apr can vary depending on several factors such as your credit score.

Source: tesatew.blogspot.com

Source: tesatew.blogspot.com

New auto loan of $20,000 for 36 months at 1.79% apr will have a monthly payment of $572. Auto rates (car rates) have dropped and you should consider refinancing your loan, especially if your credit score has improved. The latter is more important to them specifically. New auto loan of $20,000 for 36 months at 1.79% apr will have a monthly payment of $572. We will cover 5 great optio.

Source: doctorofcredit.com

Source: doctorofcredit.com

I applied at 9am and had my check at 1 pm. By phone, online and in person. On average, our members save $62 per month by refinancing their auto loan with navy federal. I�m a fan of nfcu also but on used vehicles penfed has better rates and score tiers are just a little lower to get better rates. I recently refinanced my auto with nfcu and i�m so glad i did.

A loan origination fee is what some lenders charge for processing, underwriting, and funding a loan. Navy federal lets you apply for an auto loan three ways: If you didn�t finance your auto loan at navy federal, now�s your chance! Refinance your student loans with navy federal to save time and money. My credit score is 582.

I put zero down, made my payments at 7% interest for 8 months and refinanced with nfcu to 3%. Payment saver loans and refi�s (the balloon loan i mentioned) start at 3.99% new, 4.54% used/refi. If you refinance your auto loan with navy federal, you could recieve $200 cash back after 65 days and once you’ve made your first scheduled payment. Navy federal lets you apply for an auto loan three ways: By phone, online and in person.

Source: yeah-thats-my-life.blogspot.com

Source: yeah-thats-my-life.blogspot.com

Right now, new rates start at 1.39%, used at 2.24% (if you buy using their service, otherwise 2.99%), and refi at 2.99%. Yes, you can refinance a navy federal credit union personal loan using either a new personal loan or a balance transfer credit card from a different lender. Since the repayment period is longer, monthly payments become smaller. Payment saver loans and refi�s (the balloon loan i mentioned) start at 3.99% new, 4.54% used/refi. But know nfcu ranks dti, relationship, and internal scores higher than fico scores.

Source: monstertroubleshooter.blogspot.com

Source: monstertroubleshooter.blogspot.com

Get preapproved for an auto loan with an auto loan preapproval, you could negotiate a better sales price with the dealer. Serving the navy, army, marine corps, air force, veterans, and dod. Car models of the year 2014 to the year 2016 attract new vehicle financing loans. They gave me an interest rate of 5%, which is still better than the 12% i had previously. She said based on my credit if approved my interest rate would be 12% which is bananas considering my.

She said based on my credit if approved my interest rate would be 12% which is bananas considering my. Received my loan papers by email, which i signed and emailed back. The interest rate for each car is posted on their car search site so it gave me a good idea of cap 1’s idea of how fast the car would depreciate. Iirc, it�s either tu fico 8 or tu fico 9. Since the repayment period is longer, monthly payments become smaller.

Source: youtube.com

Source: youtube.com

Refinance with us and get $200! Provided your vehicle falls within nfcu’s requirements — and you meet its eligibility criteria — you may be able to refinance your vehicle for up to 96 months. Navy federal credit union isn’t accredited, and it’s rated 1.29 out of 5 stars based on 129 reviews. Refinance with us and get $200! Your apr can vary depending on several factors such as your credit score.

Source: thesimpledollar.com

Source: thesimpledollar.com

We will cover 5 great optio. Refinance your student loans with navy federal to save time and money. I�m a fan of nfcu also but on used vehicles penfed has better rates and score tiers are just a little lower to get better rates. I just applied for a navy federal auto loan for about $12000 on a new car (i have about $7000 to put down). I put zero down, made my payments at 7% interest for 8 months and refinanced with nfcu to 3%.

Source: blog.pricespin.net

Source: blog.pricespin.net

The latter is more important to them specifically. I recieved the below message after applying for an auto refinance through nfcu. Unfortunately, your request for credit has not met navy federal lending criteria for approval. Navy federal credit union, the nation’s largest credit union, partnered with blend earlier this year to help navigate the effects of 2020’s refinance boom.many financial institutions faced similarly challenging positions this year, wading through a record number of refinance applications in the midst of a shift to a largely remote working environment. Since the repayment period is longer, monthly payments become smaller.

Source: rockloveoursongs.blogspot.com

Source: rockloveoursongs.blogspot.com

Founded in 1933 navy federal credit union offers auto refinance loans in 50 states and washington dc. If you refinance your auto loan with navy federal, you could recieve $200 cash back after 65 days and once you’ve made your first scheduled payment. Right now, new rates start at 1.39%, used at 2.24% (if you buy using their service, otherwise 2.99%), and refi at 2.99%. Navy federal credit union offers annual percentage rates (apr) which are as low as 1.79%. They gave me an interest rate of 5%, which is still better than the 12% i had previously.

Source: yeah-thats-my-life.blogspot.com

Source: yeah-thats-my-life.blogspot.com

Will navy federal refinance their own auto loan? I applied online, received an instant approval for auto refinance for the amount and term of the loan i requested. Refinance your student loans with navy federal to save time and money. Typically fees range from 0.5% to 5% of the loan amount. I would however suggest doing it within days of closing before the mortgage hits as you initially take a score drop.

Source: themortgagereports.com

Source: themortgagereports.com

I applied at 9am and had my check at 1 pm. The latter is more important to them specifically. I applied online, received an instant approval for auto refinance for the amount and term of the loan i requested. Their rates i have see go as low as a hair less than 1% even for new cars. We will cover 5 great optio.

Source: vavici.blogspot.com

Source: vavici.blogspot.com

I applied online, received an instant approval for auto refinance for the amount and term of the loan i requested. You can finance a new $15,000 vehicle for 36 months at a 1.49% apr. Learn more about refinancing your auto loan. Serving the navy army marine corps air force veterans and dod. Auto refinance loan must be at least $5,000.

Source: desingnette.blogspot.com

Source: desingnette.blogspot.com

I just applied for a navy federal auto loan for about $12000 on a new car (i have about $7000 to put down). I recently refinanced my auto with nfcu and i�m so glad i did. Founded in 1933 navy federal credit union offers auto refinance loans in 50 states and washington dc. You can finance a new $15,000 vehicle for 36 months at a 1.49% apr. Loan must be open for at least 60 days with first scheduled payment made to be eligible for the $200, which will be credited to the primary.

Source: tesatew.blogspot.com

But know nfcu ranks dti, relationship, and internal scores higher than fico scores. Loan must be open for at least 60 days with first scheduled payment made to be eligible for the $200, which will be credited to the primary. Yes, you can refinance a navy federal credit union personal loan using either a new personal loan or a balance transfer credit card from a different lender. Navy federal credit union offers car loan refinance options that can lower your interest rate and help save you money. Your apr can vary depending on several factors such as your credit score.

Navy federal credit union car loans. Will navy federal refinance their own auto loan? A loan origination fee is what some lenders charge for processing, underwriting, and funding a loan. Refinancing your car loan from another lender with navy federal could save you money and allow you to set the term that works best for you. Does navy federal auto refinance charge a late fee?

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title navy federal car refinance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.