Is car loan interest tax deductible Idea

Home » Trending » Is car loan interest tax deductible IdeaYour Is car loan interest tax deductible images are available in this site. Is car loan interest tax deductible are a topic that is being searched for and liked by netizens today. You can Find and Download the Is car loan interest tax deductible files here. Find and Download all free photos and vectors.

If you’re searching for is car loan interest tax deductible images information related to the is car loan interest tax deductible keyword, you have come to the ideal site. Our website frequently gives you hints for downloading the maximum quality video and image content, please kindly hunt and find more enlightening video content and graphics that fit your interests.

Is Car Loan Interest Tax Deductible. Mortgage interest is still deductible, but with a few caveats: You actually should be able to! If you’re audited, you have to provide proof of not only the validity of any deductions made, but prove you’re eligible to. Payments towards car loan interest don�t count as a deduction unless the car being used is for business purposes.

The State and Local Tax Deduction on Federal Taxes From thebalance.com

The State and Local Tax Deduction on Federal Taxes From thebalance.com

Interest paid on personal loans is not tax deductible. In many cases, the interest you pay on personal loans is not tax deductible. Can you deduct car loan interest when filing taxes? Unfortunately, car loan interest isn’t deductible for all taxpayers. To write off your car loan interest, you�ll have to deduct actual car expenses instead of the standard mileage rate. If you are an employee of someone else’s.

Some vehicles even come with federal and/or state tax credits.

In most cases, your car loan interest is not tax deductible. Business loans — in most cases, the interest you pay on your business loan is tax deductible. Some of the interest you pay on your mortgage, loans, or credit cards may be deductible on your tax return. If you do use your vehicle for business, a car. If you use your car for business purposes you may be allowed to partially deduct car loan interest as a business expense. If you have a car loan for the vehicle, you may also be able to deduct the interest when filing your federal tax returns.

Source: apurugby.club

Mortgage interest is still deductible, but with a few caveats: Other alternatives for deductible interest on a consumer loan as an alternative to a nondeductible consumer loan, you might consider purchasing that vehicle with a home equity line of credit. Include the interest as an expense when you calculate your allowable motor vehicle expenses. More on that coming up! The interest expense in the income statement should be tax deductible.

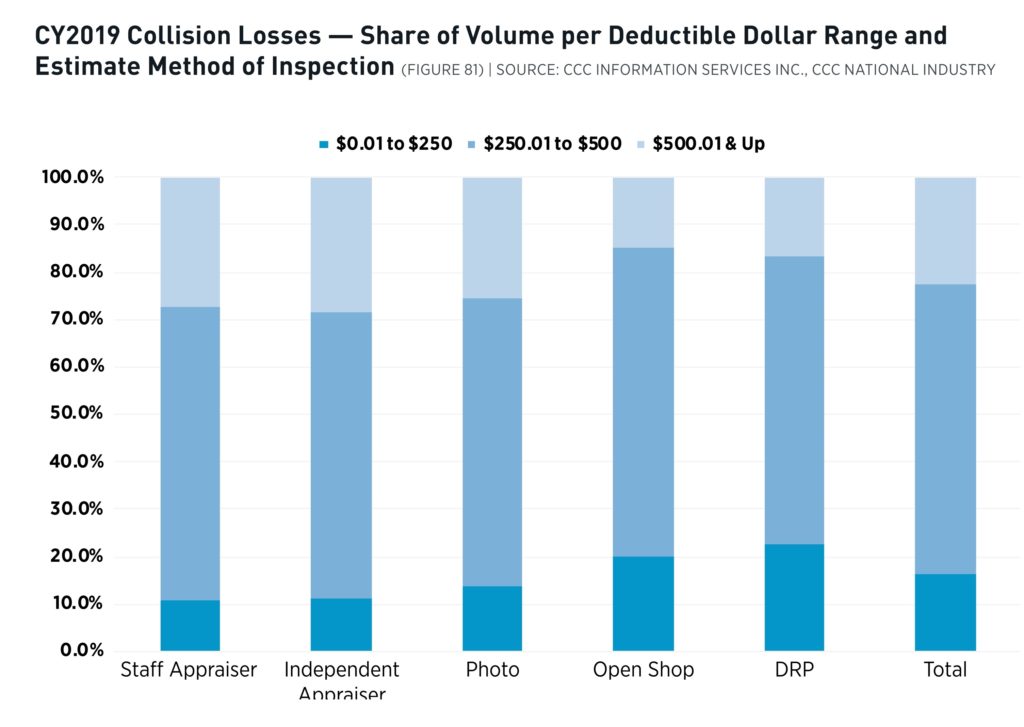

Source: repairerdrivennews.com

Source: repairerdrivennews.com

This is true for bank and credit union loans, car loans, credit card debt, lines of credit, and mortgage interest payments tied to your business. If you have an auto loan for the vehicle, you can also deduct the interest when filing your federal tax returns. If you are an employee of someone else’s. You can claim tax benefits only on interest. So, your total taxable profit for the year will be rs 47.6 lakh after deducting the interest that you paid towards repaying the car loan.

Source: apurugby.club

Some vehicles even come with federal and/or state tax credits. If you do use your vehicle for business, a car. However, you may be able to take a tax deduction if you use the loan for certain, specific purposes and meet all the eligibility requirements. You must determine the percentage of time the vehicle is driven for business needs versus personal. Credit card and installment interest incurred for personal expenses.

Source: thebalance.com

Source: thebalance.com

Some vehicles even come with federal and/or state tax credits. If you borrow to buy a car for personal use or to cover other personal expenses, the interest you pay on that loan does not reduce your tax. Interest you pay on money used to generate income may be deductible if it meets the canada revenue agency criteria. Who can deduct car expenses on your tax return? You can only claim car loan tax benefits on the interest and not the principal amount.

Source: brighthub.com

Source: brighthub.com

If you borrow to buy a car for personal use or to cover other personal expenses, the interest you pay on that loan does not reduce your tax. If you are an employee of someone else’s. You can claim tax benefits only on interest. If the vehicle in question is used for both business and personal needs, claiming this tax deduction is slightly more complicated. Typically, deducting car loan interest is not allowed.

Source: thebalance.com

Source: thebalance.com

If you borrow to buy a car for personal use or to cover other personal expenses, the interest you pay on that loan does not reduce your tax. Include the interest as an expense when you calculate your allowable motor vehicle expenses. You can only claim car loan tax benefits on the interest and not the principal amount. If the vehicle in question is used for both business and personal needs, claiming this tax deduction is slightly more complicated. Some vehicles even come with federal and/or state tax credits.

Source: paydayloansusatrc.com

Source: paydayloansusatrc.com

If the vehicle in question is used for both business and personal needs, claiming this tax deduction is slightly more complicated. If you’re looking for more ways to save money, try using the jerry app to help you save money on car insurance. Car loan interest is tax deductible if it’s a business vehicle. When can you deduct car loan interest from your taxes? For instance, assume you are a business owner, and you buy a car for commercial purposes.

Source: blog.saginfotech.com

Source: blog.saginfotech.com

Mortgage interest is still deductible, but with a few caveats: Should you use your car for work and you’re an employee, you can’t write off any of. See full answer to your question here. Taxpayers that claim interest charges for car loans as a deduction on their income taxes are sometimes targeted as candidates for an audit. Credit card and installment interest incurred for personal expenses.

Source: gobankingrates.com

Source: gobankingrates.com

Payments towards car loan interest don�t count as a deduction unless the car being used is for business purposes. Should you use your car for work and you’re an employee, you can’t write off any of. For this, you take a. For example, if you got an $800,000 mortgage to buy a house in 2017, and you paid $25,000 in. Whether interest is deductible depends on how you use the money you borrow.

Source: vicentlyh.blogspot.com

Source: vicentlyh.blogspot.com

For example, say you pay $2,000 each month for your small business loan, and $1,500 goes towards paying. If you are an employee of someone else’s. The interest expense in the income statement should be tax deductible. To write off your car loan interest, you�ll have to deduct actual car expenses instead of the standard mileage rate. Taxpayers that claim interest charges for car loans as a deduction on their income taxes are sometimes targeted as candidates for an audit.

Source: blog.allindiaitr.com

Source: blog.allindiaitr.com

Interest on car loans may be deductible if you use the car to help you earn income. Of course, there is a caveat and it’s why most people can’t use their loan payments as a tax deduction: Who can deduct car expenses on your tax return? For example, if you got an $800,000 mortgage to buy a house in 2017, and you paid $25,000 in. You can claim tax benefits only on interest.

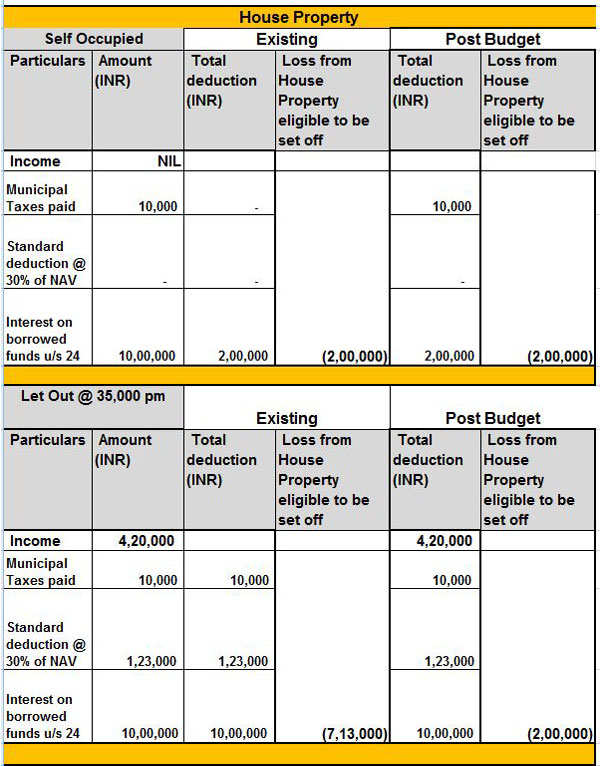

Source: economictimes.indiatimes.com

Source: economictimes.indiatimes.com

Read on for details on how to deduct car loan interest on your tax return. Business loans — in most cases, the interest you pay on your business loan is tax deductible. But, you can deduct these costs from your income tax if it�s a business car. For example, say you pay $2,000 each month for your small business loan, and $1,500 goes towards paying. If you use your car for business purposes you may be allowed to partially deduct car loan interest as a business expense.

Source: vicentlyh.blogspot.com

Source: vicentlyh.blogspot.com

Of course, there is a caveat and it’s why most people can’t use their loan payments as a tax deduction: If you are an employee of someone else’s. 15, 2017, you can deduct the interest you paid during the year on the first $750,000 of the mortgage. You actually should be able to! Types of interest not deductible include personal interest, such as:

Source: thebalance.com

Source: thebalance.com

Who can deduct car expenses on your tax return? Who can deduct car expenses on your tax return? You must determine the percentage of time the vehicle is driven for business needs versus personal. To write off your car loan interest, you�ll have to deduct actual car expenses instead of the standard mileage rate. So if you use your car for work 70% of the time, you can write off 70% of your vehicle interest.

Source: apurugby.club

Should you use your car for work and you’re an employee, you can’t write off any of. If you have an auto loan for the vehicle, you can also deduct the interest when filing your federal tax returns. If you’re audited, you have to provide proof of not only the validity of any deductions made, but prove you’re eligible to. You can claim tax benefits only on interest. However, you may be able to take a tax deduction if you use the loan for certain, specific purposes and meet all the eligibility requirements.

Source: apurugby.club

Source: apurugby.club

If the vehicle in question is used for both business and personal needs, claiming this tax deduction is slightly more complicated. Can you deduct car loan interest when filing taxes? This typically means claiming your car loan and vehicle as a business expense. So, your total taxable profit for the year will be rs 47.6 lakh after deducting the interest that you paid towards repaying the car loan. Some vehicles even come with federal and/or state tax credits.

Source: thebalance.com

Source: thebalance.com

If you are an employee of someone else’s. Other ways to save taxes on car purchase another way to save taxes on your car purchase is to show it as a depreciating asset. Is mortgage interest tax deductible 2020? Interest you pay on money used to generate income may be deductible if it meets the canada revenue agency criteria. Of course, there is a caveat and it’s why most people can’t use their loan payments as a tax deduction:

Source: thebalance.com

Source: thebalance.com

Some of the interest you pay on your mortgage, loans, or credit cards may be deductible on your tax return. You must determine the percentage of time the vehicle is driven for business needs versus personal. If you are an employee of someone else’s. Business loans — in most cases, the interest you pay on your business loan is tax deductible. Read on for details on how to deduct car loan interest on your tax return.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title is car loan interest tax deductible by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.